Why Filing an Online Tax Return in Australia Is the Fastest Means to Get Your Refund

Why Filing an Online Tax Return in Australia Is the Fastest Means to Get Your Refund

Blog Article

Simplify Your Finances: How to Submit Your Online Income Tax Return in Australia

Declaring your on the internet tax obligation return in Australia need not be a challenging task if approached carefully. Comprehending the ins and outs of the tax obligation system and adequately preparing your files are important initial steps.

Understanding the Tax System

To browse the Australian tax system efficiently, it is important to understand its basic principles and framework. The Australian tax obligation system operates on a self-assessment basis, meaning taxpayers are accountable for properly reporting their revenue and computing their tax obligations. The primary tax authority, the Australian Tax Office (ATO), looks after conformity and enforces tax laws.

The tax obligation system makes up numerous parts, including revenue tax, goods and services tax obligation (GST), and funding gains tax (CGT), to name a few. Private earnings tax is dynamic, with rates boosting as revenue surges, while company tax rates differ for little and huge businesses. Furthermore, tax offsets and deductions are available to lower taxable earnings, permitting even more customized tax responsibilities based upon individual circumstances.

Knowledge tax residency is also crucial, as it figures out a person's tax commitments. Residents are tired on their globally income, while non-residents are only tired on Australian-sourced income. Familiarity with these principles will encourage taxpayers to make enlightened choices, guaranteeing conformity and possibly optimizing their tax obligation results as they prepare to submit their on-line tax returns.

Readying Your Files

Collecting the needed records is an important action in preparing to submit your online income tax return in Australia. Appropriate paperwork not only improves the filing procedure yet also guarantees accuracy, reducing the danger of errors that might cause fines or hold-ups.

Start by collecting your revenue declarations, such as your PAYG payment recaps from employers, which information your earnings and tax obligation kept. online tax return in Australia. If you are independent, ensure you have your company revenue documents and any kind of appropriate invoices. Furthermore, gather financial institution statements and documents for any kind of interest made

Following, put together documents of insurance deductible costs. This might include invoices for occupational expenses, such as uniforms, travel, and tools, as well as any academic expenditures associated with your profession. Ensure you have documentation for rental earnings and associated expenses like repairs or building administration charges. if you have home.

Do not forget to consist of other pertinent files, such as your medical insurance details, superannuation payments, and any financial investment revenue declarations. By carefully arranging these records, you set a strong foundation for a efficient and smooth online tax obligation return process.

Selecting an Online Platform

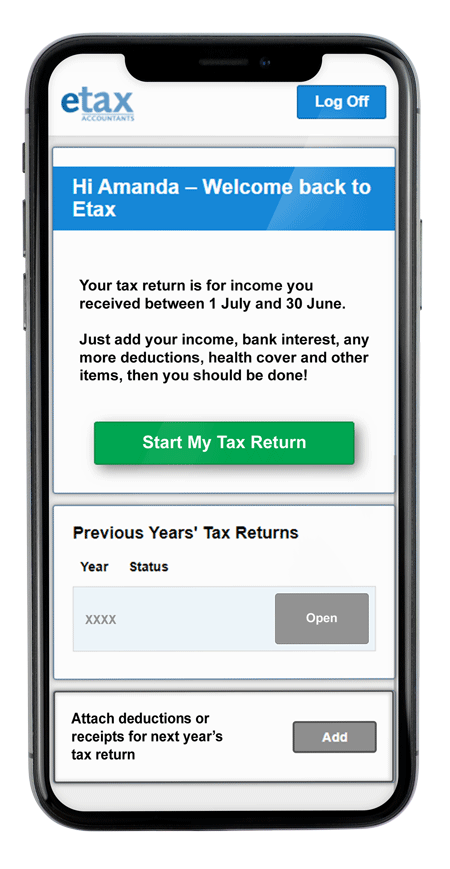

After organizing your paperwork, the following action includes choosing a proper online system for filing your tax return. online tax return in Australia. In Australia, several trustworthy systems are available, each offering distinct attributes tailored to different taxpayer needs

When choosing an on the internet system, take into consideration the user interface and ease of navigating. A straightforward style can dramatically boost your experience, making it easier to input your info accurately. Furthermore, make certain the platform is certified with the Australian Taxation Office (ATO) regulations, as this will ensure that your submission satisfies all lawful needs.

Another crucial element is the availability of client assistance. Platforms supplying online chat, phone support, or thorough FAQs can give valuable assistance if you experience obstacles during the declaring process. Additionally, analyze the security steps in position to secure your individual information. Look for platforms that make use of encryption and have a solid privacy plan.

Lastly, think about the costs related to numerous platforms. While some may offer free solutions for fundamental income tax return, others might charge fees for advanced attributes or additional assistance. Evaluate these variables to pick the platform that aligns ideal with your monetary situation and declaring demands.

Step-by-Step Declaring Procedure

The go to this website step-by-step declaring process for your on the internet income tax return in Australia is made to enhance the submission of your economic info while ensuring conformity with ATO policies. Started by gathering all necessary papers, including your revenue statements, financial institution declarations, and any kind of receipts for deductions.

As soon as you have your files all set, visit to your selected online platform and create or access your account. Input your personal information, including your Tax Documents Number (TFN) and call information. Following, enter your revenue information accurately, ensuring to include all sources of earnings such as incomes, rental revenue, or investment earnings.

After describing your revenue, relocate on to claim eligible reductions. This may consist of work-related costs, philanthropic contributions, and medical costs. Be sure to examine the ATO standards to maximize your insurance claims.

After making certain every little thing is correct, submit your tax return electronically. Monitor your account for any type of updates from the ATO regarding your tax return condition.

Tips for a Smooth Experience

Completing your on the internet tax obligation return can be a simple process with the right preparation and frame of mind. To guarantee a smooth experience, begin by gathering all required papers, such as your revenue declarations, invoices for deductions, and any other relevant monetary records. This organization lessens mistakes and saves time during the filing process.

Next, acquaint yourself with the Australian Tax Office (ATO) internet site and its on the internet services. Make use of the ATO's resources, including guides and Frequently asked questions, to clear up any uncertainties before you begin. online tax return in Australia. Think about establishing a MyGov account connected to the ATO for a streamlined declaring experience

Furthermore, capitalize on the pre-fill functionality used by the ATO, which automatically inhabits some of your details, reducing the opportunity of mistakes. Ensure you double-check all entrances for accuracy before entry.

Lastly, enable yourself sufficient time to finish the return without sensation hurried. This will certainly assist you keep focus and lower anxiety. If difficulties develop, don't wait to seek advice from a tax obligation professional or use the ATO's assistance services. Following these suggestions can cause a easy and successful on-line income tax return experience.

Conclusion

To conclude, filing an on the internet tax obligation return in Australia can be structured with cautious preparation and option of proper sources. By recognizing the tax obligation system, arranging needed papers, and picking a compliant online platform, individuals can navigate the declaring procedure effectively. Complying with an organized technique and find more using offered support guarantees accuracy and maximizes eligible reductions. Eventually, these methods contribute to a more efficient tax obligation declaring experience, simplifying financial management and boosting conformity with tax responsibilities.

Report this page